Home Financing

- Home

- Private Banking

- Home Financing

Home Financing Solutions

Whether you are building, buying, refinancing or renovating a home or a second home, The Private Bank at Commerce Trust can advise and provide you with home financing solutions to meet your unique needs.

Your Private Banking Relationship Manager works with you to:

- Provide proactive advice on potential home financing solutions based on an assessment of your personal situation and goals

- Provide personalized service to guide you through the financing process

- Serve as a single point-of-contact for all your current and ongoing banking needs at Commerce Trust

Explore how The Private Bank at Commerce Trust can help you achieve your home financing goals.

Construction Loans for

Custom Home Builds

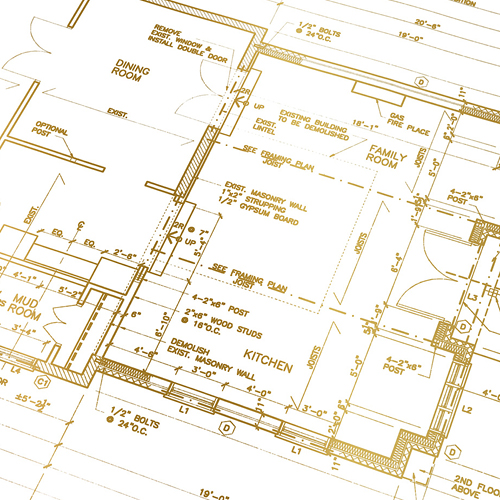

Embarking on the journey to build a custom home means you will be able to customize every feature and finish of your new home to your personal specifications, the process comes with a multitude of decisions to be made. Let The Private Bank at Commerce Trust provide the financing you need for your custom home project with the personalized service you desire for a smooth home financing process.

Working with a Commerce Trust Private Banking Relationship Manager for a construction loan provides the following benefits:

- A single point-of-contact to coordinate the construction process financing between the builder, subcontractors and the title company

- The ability to lock in your end loan interest rate prior to the start of construction

- The convenience of your Private Banking Relationship Manager to coordinate construction advances on your behalf

- Personal service from Commerce Trust for the life of your loan, because it will never be sold

Jumbo Mortgage

If you plan to upgrade your primary or vacation home and need a larger amount of financing, you may benefit from a jumbo loan. Jumbo loans start at $766,550.*

Choose The Private Bank for your jumbo loan:

- Purchase a home, refinance a home, or cash-out single family, multi-unit, and condo properties

- Close within 30 days for a new home purchase

- Explore fixed and adjustable-rate loan options

*In the Denver metropolitan area, minimum loan amount of $856,750 (single family residence) in most counties.

Ultimate Renovation

Home Loan

You’re committed to making your current home your forever home, but it needs a major renovation. Or perhaps you’ve found the perfect home to purchase, but it needs major upgrades for a growing family — a significant home addition for added living space, creating a state-of-the-art kitchen, elevating the outdoor entertaining space, or modifying features to improve mobility in your home.

For homeowners with a mortgage, the Ultimate Renovation Loan allows you to preserve the interest rate with your current mortgage and activate an Ultimate Renovation Loan in a second lien position for your renovation.

Consider the Ultimate Renovation Loan to create the home that will work for your family for years to come.*

Key Features:

- Renovation of single-family home only

- First lien1 and second lien2 loans available

- Minimum loan amount is $25,000. Maximum loan amount based on After Renovation3 loan to value (LTV).

- No maximum repair amount as long as the renovation costs do not exceed 75% of the After Renovation appraised value of the property3

- Repairs or improvements must be permanently affixed to the property

- Can be used on a primary residence or second home

- Minimum of 660 FICO® credit score

Home Equity Line

of Credit

When you’re looking at using the equity of your home to cover the cost of a home renovation, purchasing additional property, funding college tuition, a child’s wedding or any major expense you have planned, you have several options to consider. Each situation is unique, and that’s why we’re here to help you every step of the way.

Learn more about the Home Equity Line of Credit.

How do you plan to use the funds? Any large expense — especially when you don’t need the money all at once or are not sure of the total amount needed — such as college tuition, wedding planning, or home renovation

What do you want in a loan?

- Variable interest rates based on the Prime Rate4

- Monthly payments as low as interest-only

- Easy ongoing access to money for a series of expenses

- Reusable whenever you need to borrow

- Interest may be tax deductible5.

Are there discounts available? Up to 0.50% discount on the loan rate6.

Are there fees? No application fees, no bank fees at closing and no early payoff fees7.

Is there potential to save on taxes? Yes5.

What about online convenience? Use Online Banking to:

- Check loan balance

- Make payments by transferring from your Commerce checking or savings account

- Transfer funds from your Home Equity Line of Credit to Commerce checking or savings account

Additional Home Financing

Solutions

The Private Bank at Commerce Trust can also assist with specialty loans such as bridge loans and land-only loans, or high loan-to-value (LTV) loans including zero-down payment loans and cash-out refinancing.

*The Private Bank at Commerce Trust supports the markets and communities within our geographic regions and reserves the right to limit the geographic area in which loans will be made. The Private Bank at Commerce Trust does not lend in Maryland.

1First lien loans up to $1,000,000 may qualify for 95% After Renovation LTV. Loans exceeding $1,000,000 and up to $1,250,000 in value may be eligible for 90% After Renovation LTV. Loans exceeding $1,250,000 and up to $2,000,000 in value may be eligible for 85% After Renovation LTV. Loans subject to credit approval.

2Second lien loans up to $2,000,000 in value may qualify for 80% After Renovation combined loan to value (CLTV – including both first and second lien loans). Loans subject to credit approval.

3Appraiser will determine the current value of the property plus the anticipated added value of the renovations.

4The Prime Rate used to determine the APR on your account is the U.S. Prime Rate published in The Wall Street Journal in its column called “Money Rates” on the last business day of each month.

5Consult your tax advisor regarding the deductibility of interest.

6Refinancing option is limited to one discount per new loan, and is not applicable to Commerce credit card or loan account payoffs. Discounts cannot be combined with any other offer. Mortgages and dealer loans are not eligible to receive the personal loan discounts.

7Missouri, Kansas, Illinois and Colorado residents incur no fees or closing costs. Oklahoma residents are required to pay state mortgage tax of no more than $.10 per $100 of mortgage filed; no other fees or closing costs apply. Insurance must be carried on the property securing the loan.

The Private Bank at Commerce Trust is a business unit of Commerce Trust, a division of Commerce Bank, Member FDIC.

Commerce does not provide tax advice or legal advice to customers. Consult a tax specialist regarding tax implications related to any product and specific financial situation.