4 min read

Investing from a Woman's Perspective

There’s a growing body of evidence that shows the financial power of women is expanding. Commerce Trust looks at how women’s attitudes on investing are evolving and where room for improvement remains.

More and more women are seeking to achieve financial independence and security. Goals for women working to achieve that financial freedom often include a comfortable retirement, providing stability for family, or supporting causes or organizations important to them.

A major hurdle women must overcome is the disparity between men and women when it comes to retirement income. Women’s retirement income equals about 83% of men. In addition, women are 80% more likely to become impoverished after the age of 65, according to the National Institute on Retirement Security. 1

What is causing such a wide chasm when it comes to retirement incomes?

Much of the difference starts from the gender pay gap, which has hardly budged in the past 20 years. In 2022, American women typically earned 82 cents for every dollar earned by men. By comparison women earned 80 cents to the dollar in 2002. 2

A closer look at the wage gap shows women and men typically start working in much closer wage parity, according to a 2023 Pew Research Center study. Women tend to lose ground as they progress through their careers. Parenthood and family responsibilities are key factors to this.

The gender pay gap tends to widen when women are between the ages of 35 and 44, which coincides with when women are more likely to have children under 18 in the home. The study revealed a significant disparity among working parents with children in the 35–44 age group, with 94% of fathers describing themselves as active workers in comparison to 75% of mothers — a 19-percentage point variance. 3

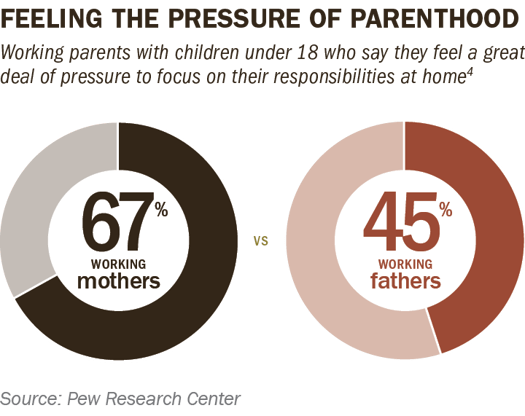

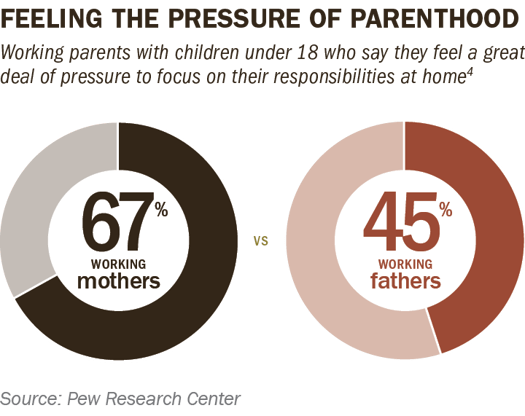

Parenthood certainly appears to have an impact on the pressures men and women feel. When it comes to feeling pressure to financially support the family, men (62%) slightly outpaced women (57%). However, two-thirds (67%) of working mothers with children under 18 say they feel a great deal of pressure to focus on their responsibilities at home in comparison to 45% of working fathers. 4

Women must contend with another significant challenge: women are more likely than men to be stereotyped when it comes to financial issues. Unconscious bias exists and manifests itself in different ways. Women are often viewed as being less knowledgeable than men about investing. Furthermore, research showed a majority of financial advisors focus their attention on the male during meetings with married heterosexual couples. 5

Attitudes on finances

When it comes to matters of finances, men and women often have similar views. A Gallup survey revealed most men and women have money invested in the stock market. In addition, both genders described their financial situations as good or excellent at roughly the same rate.

However, women more willingly admitted to having financial anxiety than men. Women tend worry more than men over various financial matters, including not having enough to pay normal monthly bills, not being able to pay for emergency medical costs and the ability to maintain current living standards. Slightly more women (65%) than men (61%) expressed concern about not having enough money for retirement. 6

.png?width=547&height=276&name=women-and-investing-chart-2---outside-investing-(1).png)

That could be changing. A 2021 study found 67% of women now invest outside of their retirement plans. This is up from 44% when the survey was conducted in 2018, representing a 50%+ increase in the number of women investors in just three years. Women also are getting into investing at younger ages. That same study found millennial women investors outnumbered their baby boomer counterparts 71% to 62%. This is particularly encouraging as nearly 70% of all respondents said they wish they had started investing their extra savings earlier than they did. 7

Interestingly, women who actively invest tend to get better results. Fidelity found that women outperformed their male counterparts by 40 basis points, or 0.4%.8 We attribute this to women taking a more balanced and diversified approach to portfolio positions and exhibiting greater patience on investing than men. For example, women generally make fewer trades, which reduces exposure to fees and commissions, and are more likely to avoid riskier assets.

.png?width=490&height=213&name=women-and-investing-chart-3---seeking-values-(1).png)

Women also appear value-minded and motivated by the possible impact of their investments. Two-thirds of women who currently invest (66%) try to invest in companies they like and that support their personal values. Moreover, 53% of women indicated they would invest (or invest more) if the investment had a clear goal or purpose for good. 9

Every solution is unique

Although the data does support gender disparities in the level of investment assets, we are not making blanket assumptions these statistics pertain to all men and women. Investors of both sexes face many pitfalls they should try to avoid. These include debt, poor cash flow, lack of preparation for big life events and being inadequately insured against risk.

At Commerce Trust, we work with a variety of female clients. In most cases, these affluent women fall into three categories: C-suite executives, entrepreneurs or CEOs of the household, with the lion’s share of responsibilities to ensure that their homes are efficiently run. However, every client is different, and therefore every solution is different.

Financial planning allows our clients and prospects to get a holistic financial picture. It is designed as a roadmap to create the financial future our clients want while also assessing the progress clients are making against those goals. Commerce Trust believes it is essential that women have a financial plan in place.

Our financial planners work in tandem with our portfolio managers to assess whether our client’s current level of risk tolerance can meet these future goals. Together, our team can determine an asset allocation that is both comfortable for the client and meets their overall objectives. We encourage you to meet with a financial team to design a roadmap to create the future you want to live.

More and more women are seeking to achieve financial independence and security. Goals for women working to achieve that financial freedom often include a comfortable retirement, providing stability for family, or supporting causes or organizations important to them.

A major hurdle women must overcome is the disparity between men and women when it comes to retirement income. Women’s retirement income equals about 83% of men. In addition, women are 80% more likely to become impoverished after the age of 65, according to the National Institute on Retirement Security. 1

What is causing such a wide chasm when it comes to retirement incomes?

Much of the difference starts from the gender pay gap, which has hardly budged in the past 20 years. In 2022, American women typically earned 82 cents for every dollar earned by men. By comparison women earned 80 cents to the dollar in 2002. 2

A closer look at the wage gap shows women and men typically start working in much closer wage parity, according to a 2023 Pew Research Center study. Women tend to lose ground as they progress through their careers. Parenthood and family responsibilities are key factors to this.

The gender pay gap tends to widen when women are between the ages of 35 and 44, which coincides with when women are more likely to have children under 18 in the home. The study revealed a significant disparity among working parents with children in the 35–44 age group, with 94% of fathers describing themselves as active workers in comparison to 75% of mothers — a 19-percentage point variance. 3

Parenthood certainly appears to have an impact on the pressures men and women feel. When it comes to feeling pressure to financially support the family, men (62%) slightly outpaced women (57%). However, two-thirds (67%) of working mothers with children under 18 say they feel a great deal of pressure to focus on their responsibilities at home in comparison to 45% of working fathers. 4

Women must contend with another significant challenge: women are more likely than men to be stereotyped when it comes to financial issues. Unconscious bias exists and manifests itself in different ways. Women are often viewed as being less knowledgeable than men about investing. Furthermore, research showed a majority of financial advisors focus their attention on the male during meetings with married heterosexual couples. 5

Attitudes on finances

When it comes to matters of finances, men and women often have similar views. A Gallup survey revealed most men and women have money invested in the stock market. In addition, both genders described their financial situations as good or excellent at roughly the same rate.

However, women more willingly admitted to having financial anxiety than men. Women tend worry more than men over various financial matters, including not having enough to pay normal monthly bills, not being able to pay for emergency medical costs and the ability to maintain current living standards. Slightly more women (65%) than men (61%) expressed concern about not having enough money for retirement. 6

.png?width=547&height=276&name=women-and-investing-chart-2---outside-investing-(1).png)

That could be changing. A 2021 study found 67% of women now invest outside of their retirement plans. This is up from 44% when the survey was conducted in 2018, representing a 50%+ increase in the number of women investors in just three years. Women also are getting into investing at younger ages. That same study found millennial women investors outnumbered their baby boomer counterparts 71% to 62%. This is particularly encouraging as nearly 70% of all respondents said they wish they had started investing their extra savings earlier than they did. 7

Interestingly, women who actively invest tend to get better results. Fidelity found that women outperformed their male counterparts by 40 basis points, or 0.4%.8 We attribute this to women taking a more balanced and diversified approach to portfolio positions and exhibiting greater patience on investing than men. For example, women generally make fewer trades, which reduces exposure to fees and commissions, and are more likely to avoid riskier assets.

.png?width=490&height=213&name=women-and-investing-chart-3---seeking-values-(1).png)

Women also appear value-minded and motivated by the possible impact of their investments. Two-thirds of women who currently invest (66%) try to invest in companies they like and that support their personal values. Moreover, 53% of women indicated they would invest (or invest more) if the investment had a clear goal or purpose for good. 9

Every solution is unique

Although the data does support gender disparities in the level of investment assets, we are not making blanket assumptions these statistics pertain to all men and women. Investors of both sexes face many pitfalls they should try to avoid. These include debt, poor cash flow, lack of preparation for big life events and being inadequately insured against risk.

At Commerce Trust, we work with a variety of female clients. In most cases, these affluent women fall into three categories: C-suite executives, entrepreneurs or CEOs of the household, with the lion’s share of responsibilities to ensure that their homes are efficiently run. However, every client is different, and therefore every solution is different.

Financial planning allows our clients and prospects to get a holistic financial picture. It is designed as a roadmap to create the financial future our clients want while also assessing the progress clients are making against those goals. Commerce Trust believes it is essential that women have a financial plan in place.

Our financial planners work in tandem with our portfolio managers to assess whether our client’s current level of risk tolerance can meet these future goals. Together, our team can determine an asset allocation that is both comfortable for the client and meets their overall objectives. We encourage you to meet with a financial team to design a roadmap to create the future you want to live.

1 Lyle Daly, “Women and Investing: 30 years of Research and Statistics Summarized,” The Motley Fool, March 1, 2023.

2,3 Rahesh Kochhar, “The enduring grip of the gender pay gap,” Pew Research Center, March 1, 2023.

4 Carolina Aragāo, “Gender Pay Gap in U.S. Hasn’t Changed Much in Two Decades,” Pew Research Center, March 1, 2023.

5 “ Seeing the Unseen: The Role Gender Plays in Wealth Management, Merrill Lynch, Aug. 26, 2020.

6 Lydia Saad, “Seven Insights into Women’s Lives in the U.S.,” Gallup Survey, March 8, 2023.

7,8 “ 2021 Women and Investing Study,” Fidelity Investments.

9 “ The Pathway to Inclusive Investment,” BNY Mellon Investment Management, Feb. 2, 2022.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certifications requirements.

The Chartered Financial Analyst® (CFA®) Charter is a designation granted by CFA Institute to individuals who have satisfied certain requirements, including completion of the CFA Program and required years of acceptable work experience. Registered marks are the property of CFA Institute.

Past performance is no guarantee of future results, and the opinions and other information in the commentary are as of August 2, 2023. This summary is intended to provide general information only and is reflective of the opinions of Commerce Trust. This material is not a recommendation of any particular security, is not based on any particular financial situation or need and is not intended to replace the advice of a qualified attorney, tax advisor or investment professional.

Diversification does not guarantee a profit or protect against all risk. Commerce Trust does not provide tax advice or legal advice to customers. Consult a tax specialist regarding tax implications related to any product and specific financial situation. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.