|

Key Highlights

|

In 2024, the U.S. national debt exceeded $34 trillion for the first time in history, a milestone that occurred less than four months after the U.S. total public debt surpassed $33 trillion.1 In addition, the federal budget deficit for fiscal year 2023 reached $1.7 trillion.

It’s against this backdrop that financial markets currently focus on when the Federal Reserve (Fed) will begin cutting interest rates. Commerce Trust believes it is equally important to understand how the Fed intends to manage its balance sheet, which is filled with U.S. Treasury securities the government issues to fund new debt and roll over existing debt obligations. If, when and how the Fed chooses to sell the U.S. Treasury securities it purchased in recent years has important implications for investors.

The Rising Dilemma of Deficits and Debt

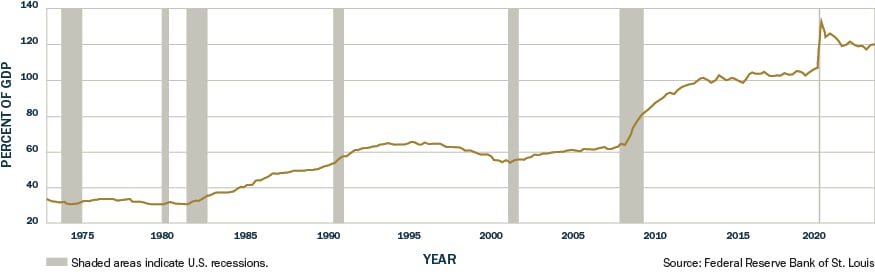

Concerns over the federal government’s fiscal health primarily center on its debt load. Last year’s federal budget deficit amounted to 6% of all U.S. economic output, and the country’s debt must increase every time the government runs an annual deficit. The national debt now exceeds total U.S. gross domestic product (GDP), producing a debt-to-GDP ratio of about 120%. (Figure 1) The Congressional Budget Office (CBO) estimates that without changes to existing laws, the U.S. debt-to-GDP ratio will reach 129% by 2033, and 192% by 2053.2 These rising debt levels could pressure the federal government’s ability to fund discretionary spending programs, which likely would filter down to create financial headwinds for businesses and consumers alike.

Figure 1 - U.S. National Debt: Total Public Debt as % of Gross Domestic Product

Another consideration is the government’s costs to service its debt have soared as interest rates have risen over the past two years. In the fourth quarter of 2023, the U.S. paid 49% more in net interest payments that it did in the same period the prior year.3 In addition, when interest rates increase, it creates a ripple effect on the rates charged to businesses, households, and local governments, and acts as a brake on economic growth.

The CBO projects interest on the debt over the next decade will surpass $10 trillion and exceed the defense budget by 2027.4 As interest expenses absorb more of the federal budget, there are simply fewer dollars available for other budgetary priorities.

Fiscal Policy and Monetary Policy Collide

During the global financial crisis in 2008, the Fed unveiled a monetary policy tool known as quantitative easing to provide additional liquidity to calm stressed markets. The Fed began purchasing U.S. Treasury and mortgage-backed securities, ultimately expanding its balance sheet from less than $1 trillion of total assets prior to the global financial crisis to $4.5 trillion at the end of 2014.

It repeated the process during the pandemic, ballooning its asset base to just under $9 trillion by March 2022. But shortly after it began raising interest rates to combat the nation’s highest inflation in 40 years, the Fed also began allowing Treasuries and mortgage-backed securities it owned to mature – a process known as quantitative tightening. Approximately $1.3 trillion of bonds have run off the Fed’s balance sheet over the past two years.5

While budgetary and fiscal realities have meant a steadily increasing supply of Treasury debt issuance, the single largest holder of that debt – the Fed —has been stepping away from the market. The U.S. central bank currently allows about $95 billion worth of Treasuries and mortgage-backed securities to mature without being replaced each month. This lack of demand has compounded the impact of the Fed’s hikes to the overnight federal funds rate, resulting in interest rates across all Treasury maturities rising to the highest levels in 15 years.

What Makes the U.S. Debt Burden Unique

Although a debt-to-GDP ratio above 100% represents an understandable level of fiscal concern, this scenario is not exclusive to the U.S. Japan, Greece, Italy, Spain, France, and the U.K. all carry debt burdens above that level. Still, the U.S. stands apart from these developed countries for several reasons.

For one, the U.S. dollar’s status as the world’s reserve currency underpins demand for Treasuries. The strong U.S. economy and abundant resources also bolster our ability to service debt. In addition, retiring baby boomers and an otherwise aging population probably will have a desire to own low-risk, long-term assets, providing another likely source of demand for Treasuries in the coming years.

Nonetheless, key upside risks to the CBO’s long-term debt outlook exist. Lower-than-expected tax revenue contributed to the wide 2023 federal deficit, and lower revenue in the future could increase debt issuance more than expected. Congress also could fail to contain discretionary spending, and rising geopolitical tension could necessitate upward pressure on defense spending.

Many economists project the Fed is likely to conclude its quantitative tightening policy and stabilize its balance sheet later this year or early in 2025. If inflation remains stubbornly high, quantitative tightening will likely continue, placing upward pressure on U.S. government yields.

What This Means From an Investment Management Perspective

As the Treasury yield curve currently remains inverted —where short-term rates are higher than longer-term equivalents— investors may consider parking cash in investments like money market funds and Treasury bills. However, rates on those short instruments appear poised to move lower in future quarters.

Commerce Trust sees opportunities in the fixed income markets, especially in longer-maturity bonds. The prospect of generating steady returns for periods as long as 30 years may make sense for investors. Adding duration to a fixed income portfolio also could act as a counterbalance to the volatility inherent in equity returns.

If you have questions about the current economic environment and potential impacts on your wealth management plan, talk with the Commerce Trust team of investment professionals.

[1] U.S. National Debt Hits Record $34 Trillion, Jan. 3, 2024, CNN Business.

[2] CBO’s Long-Term Projections of Gross Federal Debt, Sept. 8, 2023, Congressional Budget Office

[3] U.S. Avoids Government Shutdown, but Large Fiscal Deficits to Persist, Jan. 22, 2024, Fitch Ratings.

[4] 2023 Interest Costs Reach $659 Billion, Oct. 24, 2023, cfrb.org.

[5] Federal Reserve Balance Sheet Developments, November 2023, federalreserve.gov.

The Chartered Financial Analyst® (CFA®) Charter is a designation granted by CFA Institute to individuals who have satisfied certain requirements, including completion of the CFA Program and required years of acceptable work experience. Registered marks are the property of CFA Institute.

Past performance is no guarantee of future results, and the opinions and other information in the commentary are as of March 1, 2024. This summary is intended to provide general information only and is reflective of the opinions of Commerce Trust. This material is not a recommendation of any particular security, is not based on any particular financial situation or need and is not intended to replace the advice of a qualified attorney, tax advisor or investment professional.

Diversification does not guarantee a profit or protect against all risk. Commerce Trust does not provide tax advice or legal advice to customers. Consult a tax specialist regarding tax implications related to any product and specific financial situation. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Commerce Trust is a division of Commerce Bank.

Investment Products: Not FDIC Insured | May Lose Value | No Bank Guarantee

Interested in more insights?

Enter your email to subscribe.

Related Articles

Brent Schowe

Brent Schowe