3 min read

Why Portfolio Rebalancing Makes Sense

Matt Schmitt, CFA® Senior Vice President, Director of Equity Strategy

:

Feb 28, 2024 10:19:00 AM

Matt Schmitt, CFA® Senior Vice President, Director of Equity Strategy

:

Feb 28, 2024 10:19:00 AM

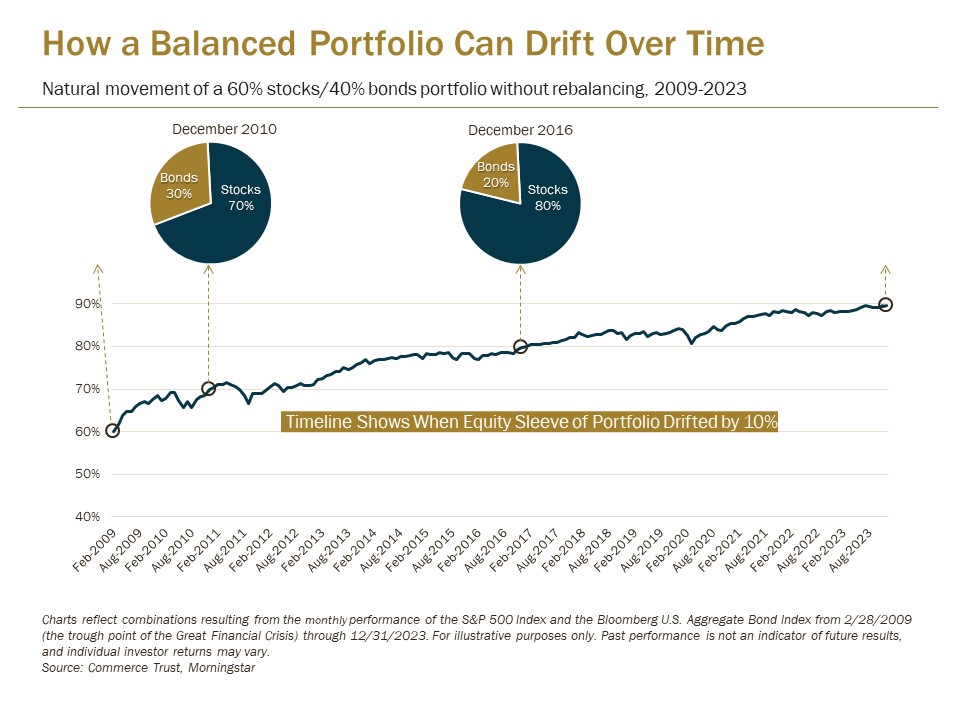

Asset allocation in a portfolio is constructed based on an investor’s goals, risk tolerance, and time horizon. It’s the course investors set for their financial futures. However, natural market movements will cause the portfolio’s allocation to shift over time, especially during volatile periods like the markets have experienced over the past several quarters.

Periodic rebalancing of the portfolio not only realigns the allocation back to its original target but can also present additional investment opportunities.

Part of Overall Wealth Management Maintenance

It’s important to remember portfolio rebalancing is about managing risk. If a portfolio becomes heavily concentrated in assets that have performed well over time, the investor could be creating greater exposure for themselves in those asset classes, especially if market conditions change and those assets don’t continue to perform the way they did in the past. In this scenario, it may make sense to sell some of those concentrated positions and redirect the proceeds to other investment opportunities that represent balancing rates of return and realign the portfolio to its intended objective.

At Commerce Trust, our financial planning and portfolio management officers work together as a team to ensure a client’s investment portfolio is appropriately allocated to deliver a risk and return balance that is aligned with their unique comprehensive wealth plan. This requires taking an aggregate view of a client’s entire investment picture, not just one account.

All investment accounts should be considered when initiating a rebalancing strategy. For example, retirement vehicles like IRAs or 401(k) accounts could be overlooked because those investments may not be actively monitored on a consistent basis. In fact, IRAs and 401(k)s may offer rebalancing opportunities without triggering any capital gains tax impact.

Tax Advantages of Rebalancing

Rebalancing a portfolio could also help provide investors with some tax relief on taxable investment accounts. Securities may become highly appreciated over time, presenting a significant capital gains tax hit when finally sold. That capital gains cost could be spread over time with rebalancing.

Another strategy to minimize tax impacts from an overweight position in highly appreciated securities could be to gift a portion of the position to a qualified charity. This would reduce a concentrated portfolio position while possibly offsetting a large capital gains tax. Investors should talk with a tax professional about strategies around the charitable gifting of appreciated securities.

How Often Should a Portfolio Be Rebalanced?

Since rebalancing helps investors manage the risks of an investment strategy, determining how often to deploy a rebalancing strategy is important. Some investors opt for a rebalancing based on when assets within the portfolio shift by a predetermined amount. Others may prefer a calendar approach to rebalancing when they are doing other financial-related tasks like preparing taxes.

Rather than rebalancing on a set cadence, Commerce Trust takes a more consultative approach. Our client teams continually monitor portfolio movements in relation to market conditions and keep clients apprised of portfolio activity. This ongoing dialogue with clients allows more timely decisions to be made regarding rebalancing or other portfolio changes.

Portfolio rebalancing is an important component of investment management that is influenced by multiple factors. It is essentially an exercise that should take place periodically to not only maximize returns but also manage risk, keep investments aligned with a portfolio strategy, and help investors stay on track to meeting their financial goals.

Next Steps

Commerce Trust is here to answer any questions you may have regarding rebalancing as part of a comprehensive wealth management plan. Contact us today and we can provide more information on our team approach to wealth management.

The Chartered Financial Analyst® (CFA®) Charter is a designation granted by CFA Institute to individuals who have satisfied certain requirements, including completion of the CFA Program and required years of acceptable work experience. Registered marks are the property of CFA Institute.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certifications requirements.

Past performance is no guarantee of future results, and the opinions and other information in the commentary are as of February 28, 2024. This summary is intended to provide general information only and is reflective of the opinions of Commerce Trust. This material is not a recommendation of any particular security, is not based on any particular financial situation or need and is not intended to replace the advice of a qualified attorney, tax advisor or investment professional.

Commerce Trust is a division of Commerce Bank. Investment Products: Not FDIC Insured / May Lose Value / No Bank Guarantee

Interested in more insights?

Enter your email to join our subscribe.

Related Articles